Listen to this article 3 min

Cash is still not only king in metro Phoenix — at least when it comes to home sales — but it's also becoming more popular.

All-cash deals represented 42.6% of all home sales in metro Phoenix in 2022, up 3% from 41.3% in 2021 and a huge jump from 23.1% in 2020, according to ATTOM Data Solutions.

Meanwhile, the share of institutional investor sales dropped by 13%, to 14.9% of all sales in 2022.

Nationally, all-cash purchases accounted for about 36.1% of total home sales in 2022. That’s the highest rate since 2013, according to ATTOM Data Solutions. In 2011 and 2012, coming off the Great Recession, cash sales totaled about 38.5% of sales.

Greg Hague, CEO of Scottsdale-based 72Sold said his agency has experienced a significant uptick in cash sales with no buyer financing over the past two years.

"This trend accelerated in the face of fast-rising interest rates last year and has not abated in 2023," Hague said.

"Initially, the increase in cash offers from noninvestor retail buyers was fueled by rising home prices, providing sellers, who then became buyers, with an abundance of cash from the equity in their previous home," Hague said. "Even though interest rates on home loans were an attractive 3% to 4% a year ago, more buyers had more cash from their previous home, so they decided to use it instead of going through the hassle of qualifying for a loan."

Another factor in rising cash sales is more seniors who tend to buy homes for cash to avoid mortgage payments in their retirement, he said. Besides, he said, many couldn't qualify for a loan because they no longer have jobs.

"I predict we will see a continuing increase in cash property sales because interest rates have risen so fast, and given the rather hawkish stance of the Federal Reserve in controlling inflation, rates may go even higher," Hague said.

Andrew Turley, a developer of luxury homes, said homes priced above $1 million have been selling for cash at a record pace, and as high as 50% in the last two years.

"Of the last 10 projects we've done, eight of our buyers have been from out of state, and half of those buyers paid cash for our luxury projects," Turley said.

Steven Hensley, advisory manager for Zonda housing market research firm, said he's also seen an influx of investor/flipper activity that are often cash transactions.

"Times with market euphoria — as experienced from mid-2020 to mid-2022 — typically bring more investors to the table," Hensley said. "We expect that investor activity and cash transactions to moderate in the short term, given macro-level uncertainties as well as falling real estate values."

Liz McDermott, a Realtor with HomeSmart, said she saw cash buyers increase from 30% in 2022 to 36% in 2023 year to date.

"The ATTOM data reflects similar trends with cash sales from 2020 to 2021 increasing by 17%," she said. "There was also an increase of 2% in cash sales from 2021 to 2022. Institutional cash sales increased significantly from 2020-2021 at a rate of 10.8% but declined by 2% from 2021-2022 due in part to less iBuyer purchasing activity."

A national lens

Nationwide, 2022's rate of all-cash purchases was up from 34.4% in 2021 and just 22.7% in 2020. And it’s likely to keep increasing, according to Rick Sharga, executive vice president of market intelligence at ATTOM.

In a statement accompanying the data, Sharga said it wouldn't be a surprise to see the percentage of all-cash purchases increase in 2023 as a result of affordability challenges for first-time buyers and others.

“Cash buyers — many, but not all of whom are investors — are in a position of competitive advantage in today’s higher interest rate environment and will continue to account for a higher-than-usual share of market at least until mortgage rates dip back down a bit,” Sharga said.

Where cash is king

Many of the top markets for cash sales are located in the Sun Belt, in states like Georgia, South Carolina, Florida and Arizona — states that are benefiting from migration trends and have been seeing significant investor activity.

Out of the top 10 metro areas for cash sales as a percentage of all sales in 2022, six were in Georgia.

In Augusta, about 72.1% of home sales were in cash, up 17% over the 61.6% in 2021 — and more than double the 30.2% share in 2020. Columbus, Georgia, saw 69% of its sales in cash in 2022, while Athens, Georgia, saw 60.6% of its sales in cash. Gainesville, Georgia, fell just shy of 59% of its sales in cash.

The cities where cash sales made up the lowest percentage of sales were more expensive coastal cities. Cash sales accounted for 17.8% of home sales in Washington, D.C., with Vallejo, California (18.8%) and San Jose (19.2%).

The price picture

The shift to cash came as the median home sale price increased about 10% in 2022, hitting an all-time annual high of $330,000.

Median home prices rose in all but two of the 157 metro areas tracked by ATTOM as part of the report. The five biggest year-over-year median price increases were all in Florida. Naples had the biggest single-year price increase at 26.9%.

Metros where prices dropped over the last year was Davenport, Iowa, which saw prices drop 2% and Shreveport, Louisiana, with prices down about 1.7%.

The ATTOM data shows that while home price appreciation is slowing due in part to higher mortgage interest rates from the Federal Reserve rate hikes designed to combat inflation, prices were still going up, albeit more slowly. The National Association of Realtors found in the fourth quarter of 2022 home prices rose about 4% compared to the same time in 2021.

“A slowdown in home prices is underway and welcomed, particularly as the typical home price has risen 42% in the past three years,” NAR Chief Economist Lawrence Yun said, noting these costs increases have far surpassed wage increases and consumer price inflation of 15% and 14%, respectively, since 2019. “Far fewer metro markets experienced double-digit price gains in the latest quarter.”

But don’t expect massive price drops either, Yun said. In fact, some signs point to buyers already coming back to the market.

“Even with a projected reduction in home sales this year, prices are expected to remain stable in the vast majority of the markets due to extremely limited supply,” Yun added. “Moreover, there are signs that buyers are returning as mortgage rates decline, even with inventory levels near historic lows.”

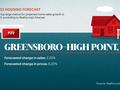

Here are the top metros for projected home sales growth in 2023, according to Realtor.com.