The Polyacrylamide Market size was valued at USD 6.51 Billion in 2023 and the total Polyacrylamide Market revenue is expected to grow at a CAGR of 7.3% from 2023 to 2030, reaching nearly USD 10.66 Billion in 2030. Polyacrylamide is a cross-linked Polymer of Acrylamide. It is highly water-absorbent, forming a soft gel when hydrated. It is used in Polyacrylamide gel electrophoresis, a subdermal filler for aesthetic facial surgery, and in soft contact lenses. In agriculture, polyacrylamide is used as a soil conditioner and a means to improve water retention in soil, thereby enhancing crop yield. Papermaking and pulp processing both include polyacrylamide as an additive to boost the Polyacrylamide market. 1.Around 35% of polyacrylamide is used in the oil and mineral industries, it is utilized for applications in enhanced oil recovery (EOR) and mineral processing AND Gas Industry. Increasing penetration of the product in water purification activities as a flocculating agent is expected to drive the demand for polyacrylamide. Polyacrylamide shows adaptability across various industries from environmental and industrial to biomedical fields. Some of the key players in the market include SNF, BASF, CNPC, Ashland, Kemira, Anhui Jucheng Fine Chemical Co, Ltd. (CJCC), Black Rose Industries Ltd., Shandong Polymer Bio-chemicals Co., Ltd., and Xitao Polymer Co., Ltd. North America is the fastest-growing region with a market share of over 28.5% in 2023. The region is expected to grow at a CAGR of 7.3% during the forecast period and maintain its dominance by 2030. The shale gas boom in North America has led to increased use of polyacrylamide in hydraulic fracturing operations. Polyacrylamide is used as a friction reducer and viscosity modifier in fracking fluids, helping to improve the efficiency of the extraction process. Improving the performance and cost-effectiveness of polyacrylamide products and Innovations in polymer chemistry and manufacturing processes are expected to drive market growth in North America.To know about the Research Methodology :- Request Free Sample Report

Polyacrylamide Market Dynamics:

Rising Demand for Petroleum Fuels The petroleum industry makes significant use of anionic polyacrylamide to improve oil recovery. The rising demand for polyacrylamide in manufacturing and construction relies greatly on petroleum-based fuels for operations, machinery, and heating. The production of polyacrylamide depends on raw ingredients from petrochemical sources including acrylic acid and acrylonitrile. Price fluctuations for crude oil are able to have a direct effect on the cost of raw materials, so manufacturers of polyacrylamide inhibit the development of the market. Polyacrylamide is essential for optimizing oil recovery and enhancing the effectiveness of the oil and gas industry. The polyacrylamide market is being driven by several factors, including the rising demand for products from the oil and gas, water and wastewater treatment, pulp and paper, mining, and food and beverage industries. The increased demand for improved oil recovery is a major driver of market growth. The Asia Pacific region's high consumption, cheap labor, and land costs, and a shortage of raw materials are all driving the rapid growth of the polyacrylamide market.Potential Side Effects and Safety Concerns Direct contact with Polyacrylamide causes skin irritation as well as eye irritation leading to redness, and discomfort. Numerous adverse effects, such as neurotoxicity and organ system toxicity, have been caused by polyacrylamide. Polyacrylamide is also used as a facial soft tissue filler in facial surgery the complications like sensitivity, swelling, lumpiness, abscess formation, change in face look, and change in gel position after injection. Employees who handle, apply, or manufacture polyacrylamide products run the risk of coming into contact with chemical hazards.

Polyacrylamide Market Segment Analysis :

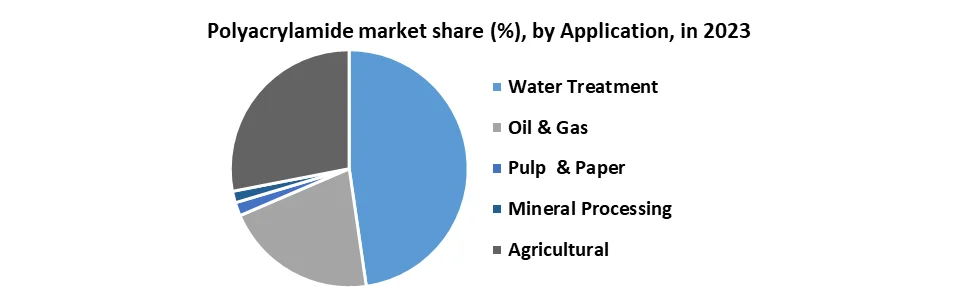

Based on Type, the Anionic type segment held the largest market share of about 38.1% in the Polyacrylamide Market in 2023. According to the MMR analysis, the segment is expected to grow at a CAGR of 7.3% during the forecast period and maintain its dominance till 2030. The anionic polyacrylamide polymers have a high demand for industrial wastewater treatment and municipal sewage treatment as flocculating agents. The increasing impure water discharge from industries, and the growing shortage of drinking water, are expected to drive demand for polyacrylamide in water treatment. Cationic polyacrylamide is projected to be the fastest-growing segment during the forecast period thanks to the increasing use of cationic polyacrylamide in diverse industries, such as additives in building & construction, removal of color and desalination in wastewater treatment, cell separation in biotechnological broths.Based on Applications, the water treatment segment held the largest market share of about 36.4% in the Polyacrylamide Market in 2023 and is expected to maintain its dominance till 2030. In water treatment, Polyacrylamide is a water-soluble polymer that is used as a flocculant for the purification of industrial water, drainage, sewage, and wastewater treatment. It is also utilized in the drinking water industry. Rising water pollution and the growing scarcity of potable water are driving the demand for polyacrylamide in water treatment applications.

Regional Analysis of Polyacrylamide Market:

Asia-Pacific region dominates the Polyacrylamide Market with the largest market share accounting for 39.4% in 2023, the region is expected to grow during the forecast period and maintain its dominance by 2030. The Asia Pacific region is often a significant market because of rapid industrialization and urbanization in countries like China and India driven by industrial growth and increasing environmental regulations.Europe, the fastest-growing region in the Polyacrylamide Market held a market share of 22.8% and is significantly growing with a CAGR of xx% during its forecast period. Sustainable agriculture and soil management technology are expected to grow rapidly in Europe. A significant demand from the mining, paper, and water treatment sectors. SNF Floerger and BASF SE. are leading players in the Polyacrylamide market. Latin America represents a smaller but growing market for polyacrylamide, with the support of Brazil, Mexico, Argentina, and Chile are key markets in this region. Middle East and Africa are emerging markets for polyacrylamide, driven by growing water treatment activities, oil and gas exploration, and infrastructure development.

Competitive Landscape for Polyacrylamide Market:

The competitive landscape of the Polyacrylamide market is constantly evolving, with new players emerging and established players adapting their strategies. Leading companies in the Polyacrylamide market including ASE SE, Black Rose Chemicals, Envitech Chemical Specialties Pvt. Ltd., Kemira, Shuiheng Chemicals, SINOPEC, SNF Group, Anhui Tianrun Chemicals Co. Ltd., Xitao Polymer Co. Ltd., Chinafloc utilize broad techniques to build on and broaden their market impact. A key component of their strategy is their constant commitment to research and development (R&D) to maintain a leading position in technological development. April 2023 Ashland Inc. announced the expansion of its polyacrylamide production capacity in China. The expansion is expected to be completed in the second half of 2023. In July 2022, Governor John Bel Edwards and SNF holding company president John Pittman confirmed the company is investing an additional $375 million to expand its water treatment and water-conditioning polymer production plant near Plaquemine, Louisiana. BASF SE (Germany) is one of the leading chemical producers in the world. The company has an extensive regional presence with subsidies and joint ventures in more than 80 countries and operates 390 production sites in Europe, Asia-Pacific, North America, and Africa. BASF has customers across more than 190 countries and supplies products to a range of industries. NF, BASF, and Kemira are a few of the top polyacrylamide manufacturers. The multinationals are expanding their production bases and volumes to strengthen their roots in the market. Moreover, the market has numerous small-scale players, selling their products in the domestic market. These players are likely to offer competitive pricing to gain market share against these major players. In April 2021, BASF extended the production of polyacrylamide powder in China, Nanjing. China expands BASF’s global Polyacrylamide manufacturing for the mining and oilfield industries which relies primarily on long-term supply agreements with production units in Europe, Australia.Polyacrylamide Market Scope: Inquire before buying

Polyacrylamide Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US$ 6.51 Bn. Forecast Period 2024 to 2030 CAGR: 7.3% Market Size in 2030: US$ 10.66 Bn. Segments Covered: by Type Anionic Cationic Non-ionic by Application Water Treatment Oil & Gas Pulp and Paper Mineral processing by Physical Form Powder Liquid Emulsion / Dispersion Polyacrylamide Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players are:

1. SNF Group 2. China National Petroleum Corporation 3. BASF SE 4. The Dow Chemical Company 5. Petro China Company Limited 6. Black Rose Industries Ltd. 7. Xitao Polymer Co. Ltd. 8. Kemira OYJ 9. Zl Petrochemical CO 10. Anhui Juchng Fine Chemicals Co. Ltd. 11. Jiangsu Feymer Technology 12. Chinafloc 13. Anhui Tianrun 14. Shandong Polymer Biochemicals Co. Ltd. Frequently Asked Questions: 1] What segments are covered in the Polyacrylamide Market report? Ans. The segments covered in the Polyacrylamide Market report are based on Type and Application. 2] Which region is expected to hold the highest share in the Polyacrylamide Market? Ans. The Asia-Pacific region is expected to hold the highest share of the Polyacrylamide Market. 3] What is the market size of the Polyacrylamide Market? Ans. The Polyacrylamide Market size was valued at USD 6.51 Billion in 2023 reaching nearly USD 10.66 Billion in 2030. 4] What is the forecast period for the Polyacrylamide Market? Ans. The forecast period for the Polyacrylamide Market is 2024-2030. 5] What is the growth rate of the Polyacrylamide Market? Ans. The Polyacrylamide market is expected to grow at a CAGR of 7.3% during the forecast period of 2023 to 2030.

1. Polyacrylamide Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Polyacrylamide Market: Dynamics 2.1. Global Polyacrylamide Market Trends by Region 2.1.1. North America Polyacrylamide Market Trends 2.1.2. Europe Polyacrylamide Market Trends 2.1.3. Asia Pacific Polyacrylamide Market Trends 2.1.4. Middle East and Africa Polyacrylamide Market Trends 2.1.5. South America Polyacrylamide Market Trends 2.2. Global Polyacrylamide Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Polyacrylamide Market Drivers 2.2.1.2. North America Polyacrylamide Market Restraints 2.2.1.3. North America Polyacrylamide Market Opportunities 2.2.1.4. North America Polyacrylamide Market Challenges 2.2.2. Europe 2.2.2.1. Europe Polyacrylamide Market Drivers 2.2.2.2. Europe Polyacrylamide Market Restraints 2.2.2.3. Europe Polyacrylamide Market Opportunities 2.2.2.4. Europe Polyacrylamide Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Polyacrylamide Market Drivers 2.2.3.2. Asia Pacific Polyacrylamide Market Restraints 2.2.3.3. Asia Pacific Polyacrylamide Market Opportunities 2.2.3.4. Asia Pacific Polyacrylamide Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Polyacrylamide Market Drivers 2.2.4.2. Middle East and Africa Polyacrylamide Market Restraints 2.2.4.3. Middle East and Africa Polyacrylamide Market Opportunities 2.2.4.4. Middle East and Africa Polyacrylamide Market Challenges 2.2.5. South America 2.2.5.1. South America Polyacrylamide Market Drivers 2.2.5.2. South America Polyacrylamide Market Restraints 2.2.5.3. South America Polyacrylamide Market Opportunities 2.2.5.4. South America Polyacrylamide Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Regulatory Landscape by Region 2.5.1. North America 2.5.2. Europe 2.5.3. Asia Pacific 2.5.4. Middle East and Africa 2.5.5. South America 2.6. Analysis of Government Schemes and Initiatives For the Polyacrylamide Industry 3. Polyacrylamide Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2023-2030) 3.1. Polyacrylamide Market Size and Forecast, by Type (2023-2030) 3.1.1. Anionic 3.1.2. Cationic 3.1.3. Non-ionic 3.2. Polyacrylamide Market Size and Forecast, by Application (2023-2030) 3.2.1. Water Treatment 3.2.2. Oil & Gas 3.2.3. Pulp and Paper 3.2.4. Mineral processing 3.3. Polyacrylamide Market Size and Forecast, by Physical form (2023-2030) 3.3.1. Powder 3.3.2. Liquid 3.3.3. Emulsion / Dispersion 3.4. Polyacrylamide Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Polyacrylamide Market Size and Forecast by Segmentation (by Value in USD Billion) (2023-2030) 4.1. North America Polyacrylamide Market Size and Forecast, by Type (2023-2030) 4.1.1. Anionic 4.1.2. Cationic 4.1.3. Non-ionic 4.2. North America Polyacrylamide Market Size and Forecast, by Application (2023-2030) 4.2.1. Water Treatment 4.2.2. Oil & Gas 4.2.3. Pulp and Paper 4.2.4. Mineral processing 4.2.5. North America Polyacrylamide Market Size and Forecast, by Physical Form (2023-2030) Powder 4.2.6. Liquid 4.2.7. Emulsion / Dispersion 4.3. North America Polyacrylamide Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States Polyacrylamide Market Size and Forecast, by Type (2023-2030) 4.3.1.1.1. Anionic 4.3.1.1.2. Cationic 4.3.1.1.3. Non-ionic 4.3.1.2. United States Polyacrylamide Market Size and Forecast by Application (2023-2030) 4.3.1.2.1. Water Treatment 4.3.1.2.2. Oil & Gas 4.3.1.2.3. Pulp and Paper 4.3.1.2.4. Mineral processing 4.3.1.3. United States Polyacrylamide Market Size and Forecast, by Physical Form (2023-2030) 4.3.1.3.1. Powder 4.3.1.3.2. Liquid 4.3.1.3.3. Emulsion/dispersion 4.3.2. Canada 4.3.2.1. Canada Polyacrylamide Market Size and Forecast, by Type(2023-2030) 4.3.2.1.1. Anionic 4.3.2.1.2. Cationic 4.3.2.1.3. Non-ionic 4.3.2.2. Canada Polyacrylamide Market Size and Forecast, by Application (2023-2030) 4.3.2.2.1. Water Treatment 4.3.2.2.2. Oil & Gas 4.3.2.2.3. Pulp and Paper 4.3.2.2.4. Mineral processing 4.3.2.3. Canada Polyacrylamide Market Size and Forecast, by Physical form (2023-2030) 4.3.2.3.1. Powder 4.3.2.3.2. Liquid 4.3.2.3.3. Emulsion / Dispersion 4.3.3. Mexico 4.3.3.1. Mexico Polyacrylamide Market Size and Forecast, by Type (2023-2030) 4.3.3.1.1. Anionic 4.3.3.1.2. Cationic 4.3.3.1.3. Non-ionic 4.3.3.2. Mexico Polyacrylamide Market Size and Forecast, by Application (2023-2030) 4.3.3.2.1. Water Treatment 4.3.3.2.2. Oil & Gas 4.3.3.2.3. Pulp and Paper 4.3.3.2.4. Mineral processing 4.3.3.3. Mexico Polyacrylamide Market Size and Forecast, by Physical Form (2023-2030) 4.3.3.3.1. Powder 4.3.3.3.2. Liquid 4.3.3.3.3. Emulsion / Dispersion 5. Europe Polyacrylamide Market Size and Forecast by Segmentation (by Value in USD Billion) (2023-2030) 5.1. Europe Polyacrylamide Market Size and Forecast, by Type (2023-2030) 5.2. Europe Polyacrylamide Market Size and Forecast, by Application (2023-2030) 5.3. Europe Polyacrylamide Market Size and Forecast, by Physical Form (2023-2030) 5.4. Europe Polyacrylamide Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Polyacrylamide Market Size and Forecast, by Type (2023-2030) 5.4.1.2. United Kingdom Polyacrylamide Market Size and Forecast, by Application (2023-2030) 5.4.1.3. United Kingdom Polyacrylamide Market Size and Forecast, by Physical Form (2023-2030) 5.4.2. France 5.4.2.1. France Polyacrylamide Market Size and Forecast, by Type (2023-2030) 5.4.2.2. France Polyacrylamide Market Size and Forecast, by Application (2023-2030) 5.4.2.3. France Polyacrylamide Market Size and Forecast, by Physical form (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Polyacrylamide Market Size and Forecast, by Type (2023-2030) 5.4.3.2. Germany Polyacrylamide Market Size and Forecast by Application (2023-2030) 5.4.3.3. Germany Polyacrylamide Market Size and Forecast, by Physical form (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Polyacrylamide Market Size and Forecast, by Type (2023-2030) 5.4.4.2. Italy Polyacrylamide Market Size and Forecast by Application (2023-2030) 5.4.4.3. Italy Polyacrylamide Market Size and Forecast, by Physical Form (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Polyacrylamide Market Size and Forecast, by Type (2023-2030) 5.4.5.2. Spain Polyacrylamide Market Size and Forecast, by Application (2023-2030) 5.4.5.3. Spain Polyacrylamide Market Size and Forecast, by Physical Form (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Polyacrylamide Market Size and Forecast, by Type (2023-2030) 5.4.6.2. Sweden Polyacrylamide Market Size and Forecast, by Application (2023-2030) 5.4.6.3. Sweden Polyacrylamide Market Size and Forecast, by Physical form (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Polyacrylamide Market Size and Forecast, by Type (2023-2030) 5.4.7.2. Austria Polyacrylamide Market Size and Forecast, by Application (2023-2030) 5.4.7.3. Austria Polyacrylamide Market Size and Forecast, by Physical Form (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Polyacrylamide Market Size and Forecast, by Type (2023-2030) 5.4.8.2. Rest of Europe Polyacrylamide Market Size and Forecast, by Application (2023-2030) 5.4.8.3. Rest of Europe Polyacrylamide Market Size and Forecast, by Physical form (2023-2030) 6. Asia Pacific Polyacrylamide Market Size and Forecast by Segmentation (by Value in USD Billion) (2023-2030) 6.1. Asia Pacific Polyacrylamide Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Polyacrylamide Market Size and Forecast, by Application (2023-2030) 6.3. Asia Pacific Polyacrylamide Market Size and Forecast, by Physical form (2023-2030) 6.4. Asia Pacific Polyacrylamide Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Polyacrylamide Market Size and Forecast, by Type (2023-2030) 6.4.1.2. China Polyacrylamide Market Size and Forecast, by Application (2023-2030) 6.4.1.3. China Polyacrylamide Market Size and Forecast, by Physical form (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Polyacrylamide Market Size and Forecast, by Type (2023-2030) 6.4.2.2. S Korea Polyacrylamide Market Size and Forecast, by Application (2023-2030) 6.4.2.3. S Korea Polyacrylamide Market Size and Forecast, by Physical form (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Polyacrylamide Market Size and Forecast, by Type (2023-2030) 6.4.3.2. Japan Polyacrylamide Market Size and Forecast, by Application (2023-2030) 6.4.3.3. Japan Polyacrylamide Market Size and Forecast, by Physical form (2023-2030) 6.4.4. India 6.4.4.1. India Polyacrylamide Market Size and Forecast, by Type (2023-2030) 6.4.4.2. India Polyacrylamide Market Size and Forecast, by Application (2023-2030) 6.4.4.3. India Polyacrylamide Market Size and Forecast, by Physical form (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Polyacrylamide Market Size and Forecast, by Type (2023-2030) 6.4.5.2. Australia Polyacrylamide Market Size and Forecast, by Application (2023-2030) 6.4.5.3. Australia Polyacrylamide Market Size and Forecast, by Physical form (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Polyacrylamide Market Size and Forecast, by Type (2023-2030) 6.4.6.2. Indonesia Polyacrylamide Market Size and Forecast, by Application (2023-2030) 6.4.6.3. Indonesia Polyacrylamide Market Size and Forecast, by Physical form (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Polyacrylamide Market Size and Forecast, by Type (2023-2030) 6.4.7.2. Malaysia Polyacrylamide Market Size and Forecast, by Application (2023-2030) 6.4.7.3. Malaysia Polyacrylamide Market Size and Forecast, by Physical form (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Polyacrylamide Market Size and Forecast, by Type (2023-2030) 6.4.8.2. Vietnam Polyacrylamide Market Size and Forecast, by Application (2023-2030) 6.4.8.3. Vietnam Polyacrylamide Market Size and Forecast, by Physical form (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Polyacrylamide Market Size and Forecast, by Type (2023-2030) 6.4.9.2. Taiwan Polyacrylamide Market Size and Forecast, by Application (2023-2030) 6.4.9.3. Taiwan Polyacrylamide Market Size and Forecast, by Physical form (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Polyacrylamide Market Size and Forecast, by Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Polyacrylamide Market Size and Forecast, by Application (2023-2030) 6.4.10.3. Rest of Asia Pacific Polyacrylamide Market Size and Forecast, by Physical Form (2023-2030) 7. Middle East and Africa Polyacrylamide Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2030) 7.1. Middle East and Africa Polyacrylamide Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Polyacrylamide Market Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa Polyacrylamide Market Size and Forecast, by Physical form (2023-2030) 7.4. Middle East and Africa Polyacrylamide Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Polyacrylamide Market Size and Forecast, by Type (2023-2030) 7.4.1.2. South Africa Polyacrylamide Market Size and Forecast, by Application (2023-2030) 7.4.1.3. South Africa Polyacrylamide Market Size and Forecast, by Physical form (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Polyacrylamide Market Size and Forecast, by Type (2023-2030) 7.4.2.2. GCC Polyacrylamide Market Size and Forecast by Application (2023-2030) 7.4.2.3. GCC Polyacrylamide Market Size and Forecast, by Physical form (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Polyacrylamide Market Size and Forecast, by Type (2023-2030) 7.4.3.2. Nigeria Polyacrylamide Market Size and Forecast, by Application (2023-2030) 7.4.3.3. Nigeria Polyacrylamide Market Size and Forecast, by Physical form (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Polyacrylamide Market Size and Forecast, by Type (2023-2030) 7.4.4.2. Rest of ME&A Polyacrylamide Market Size and Forecast, by Application (2023-2030) 7.4.4.3. Rest of ME&A Polyacrylamide Market Size and Forecast, by Physical form (2023-2030) 8. South America Polyacrylamide Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2030) 8.1. South America Polyacrylamide Market Size and Forecast, by Type (2023-2030) 8.2. South America Polyacrylamide Market Size and Forecast, by Application (2023-2030) 8.3. South America Polyacrylamide Market Size and Forecast, by Physical form (2023-2030) 8.4. South America Polyacrylamide Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Polyacrylamide Market Size and Forecast, by Type (2023-2030) 8.4.1.2. Brazil Polyacrylamide Market Size and Forecast, by Application (2023-2030) 8.4.1.3. Brazil Polyacrylamide Market Size and Forecast, by Physical form (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Polyacrylamide Market Size and Forecast, by Type (2023-2030) 8.4.2.2. Argentina Polyacrylamide Market Size and Forecast, by Application (2023-2030) 8.4.2.3. Argentina Polyacrylamide Market Size and Forecast, by Physical form (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Polyacrylamide Market Size and Forecast, by Type (2023-2030) 8.4.3.2. Rest Of South America Polyacrylamide Market Size and Forecast, by Application (2023-2030) 8.4.3.3. Rest Of South America Polyacrylamide Market Size and Forecast, by Physical Form 2024-2030) 9. Polyacrylamide Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Polyacrylamide Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. BASF SE (Germany) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on partnership 10.1.8. Regulatory Accreditations and certifications Received by Them 10.1.9. Awards Received by the firm 10.1.10. Recent Developments 10.2. SNF Group 10.3. China National Petroleum Corporation 10.4. The Dow Chemical Company 10.5. Petro China Company Limited 10.6. Black Rose Industries Ltd. 10.7. Xitao Polymer Co. Ltd. 10.8. Kemira OYJ 10.9. Zl Petrochemical CO 10.10. Anhui Juchng Fine Chemicals Co. Ltd. 10.11. Jiangsu Feymer Technology 10.12. Chinafloc 10.13. Anhui Tianrun 10.14. Shandong Polymer Biochemicals Co. Ltd. 11. Key Findings 12. Industry Recommendations 13. Polyacrylamide Market: Research Methodology