Click here if you want to read this article in French.

Did you know that with only $10K, you can open your own business to distribute your card to your customers as if you were a bank? You won't need to buy Gift cards to sell to your customers anymore. It works the same way as a bank-issued card. Your future customers will be able to manage all their expenses without any problem and without having to contact you. To be clear and precise with you. It will work like Wise, and Payoneer cards. If you are interested, I wish you a good read.

To distribute payment cards to your online clients. You will need to partner with another online business that will be liable for distributing your cards (virtual and physical) to your customers. Once you submit your application to them and they accept it. You will have the capacity to link their API to your business so that your customers can check and reload their accounts properly. You don't have to go anywhere to make a physical connection with the company. There lives a company called "Stripe Issuing" that offers this online service that you can link to your business to distribute your cards (virtual and physical) without any hassle.

Stripe Issuing is a Stripe option launched in the UK which allows other businesses to easily create, manage and distribute virtual and physical payment cards to their customers. It gives full access to its companies' customers to check and see how and where their money has stood spent on their cards. You will have full access to control the card of any client of your business. You can give your customers budgetary power by controlling and limiting the spending on their cards. This way, if you don't have much budget available in your account, you can manage the budgeting activity of your customers and your business.

No. Using Stripe Issuing is not free. To use their service, you must pay a fee. There are a total of eight(8) costs listed in Stripe Issuing's terms of service. However, these fees will be applied based on your customer's usage.

Here is a list of all Stripe Issuing fees.

1. Card order fee.

2. Issuing connection fee.

3. ACH transfer fee.

4. Cross-border fee.

5. Foreign exchange fee.

6. Litigation fees.

Once they have approved your application and you are ready to provide cards to your customers, you should be aware that they will apply a fee when you order a card for your customer. This means that they will use two kinds of fees for your business for creating the card.

Here are the two types of fees they charge for creating the card.

A. Virtual card possession fee.

To provide the virtual card to your customers. They will charge you a fee of $0.10. Be aware that the card will automatically be available as soon as you pay this amount for your customer.

B. The cost of owning a physical card.

Your customer's physical card order fee stands separated into several parts. The cost of making the physical card ($3.00) must stand paid first. Next, you must pay the shipping cost of the card. Please be aware that depending on your country and the delivery method you choose, the cost of sending a physical card to your customer may vary. Another thing you should know about card delivery. Single card deliveries in the US are less expensive than in the UK and other European countries. Here is a deeper explanation to understand how their fees work that they apply on the delivery of their physical card.

Price for delivery of physical cards in the United States.

Physical card deliveries issued by Stripe in the United States stand shipped in two delivery types: Individual and Bulk.

Individual: The "Individual" delivery type live used in case your customer has ordered a single card. It will be packaged in a letter and shipped in a standard-size envelope to your customer's address. The only problem is that the shipping cost will be higher than bulk orders.

Bulk: This type of delivery is used for your customers who order many cards from you at once. The only difference with the "Individual" delivery type is that the bulk card orders will not be wrapped in a letter and packed in an envelope. Instead, they will all stand placed in a box and delivered to your customer's address.

Price for delivery of physical cards from Stripe Issuing in the US if your customer ordered a single card.

Stripe Issuing offers three types of shipping for single card orders: Standard, Express, and Priority shipping.

The shipping cost for standard delivery of a single physical card from Issuing is $0.50. You may receive the card within 5-8 business days.

The shipping cost for Express delivery is $16 for single physical card orders.

The shipping cost for priority delivery is $22 for single physical card orders.

Price of Stripe Issuing physical card delivery in the US if your customer ordered multiple physical cards.

Stripe Issuing also offers the same types of shipping for bulk orders of physical cards.

The shipping fee for standard shipping is $25 for bulk cards.

The shipping cost for Express Delivery is $30 for bulk cards.

The cost for priority delivery is $48 for bulk cards.

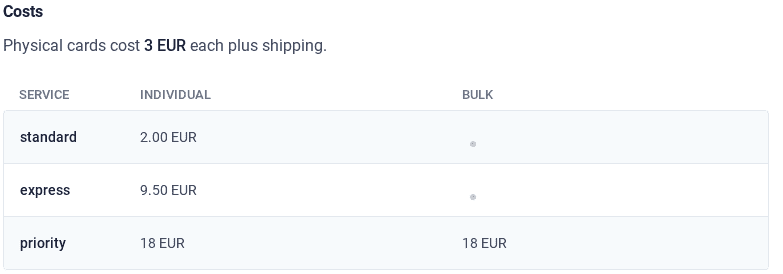

Delivery price for Stripe Issuing physical cards in the European Union.

Stripe Issuing offers the same types of shipping within the European Union. The only difference is that the price of shipping physical cards to European countries is higher than sending them to the US. To give you an idea of the costs, here is a list of Stripe Issuing's physical card shipping costs if your customer orders a single card from you.

The shipping cost for standard delivery is 2 EUR for one card.

The shipping cost for Express delivery is 2 EUR for one card.

The shipping cost for standard delivery is 18 EUR for one card.

Here is the price for delivery of Stripe Issuing physical cards in bulk to European countries.

Stripe Issuing will not charge you shipping fees for bulk physical cards to your customers who live in European countries when you choose standard shipping.

Stripe Issuing will not charge you shipping fees for bulk physical cards to your customers who live in European countries.

There will be a shipping charge for bulk orders when you choose priority shipping. The shipping cost for priority delivery is 18 EUR. The shipping cost stands the same when your customer orders a single physical card.

Delivery price for Stripe Issuing's physical cards in the UK.

Stripe Issuing offers the same types of shipping in the UK. The only difference is that the price for shipping physical cards to European countries is higher than in the UK when you choose standard and express shipping types. Here is the price of Stripe Issuing physical card delivery when your UK customers order a single card from you.

When your UK customer orders a card and chooses standard shipping. They will pay 1 GBP for shipping. That's equivalent to between 1 and 1.16 EUR, whereas if they were in Europe, their charge would be 2 EUR.

When your customer orders his card for the UK and chooses Express shipping, the shipping cost of his card will be 6.5 GBP. That's equivalent to approximately 7.54 EUR, while the European one is 9.5 EUR.

There will be a bulk shipping charge for priority shipping. Its shipping costs will be 18 GBP.

Here is the price for Stripe Issuing physical card delivery when your UK customers order multiple physical cards from you.

When you choose standard shipping, there is no charge for orders of Stripe Issuing bulk cards for your customers to the UK.

When you choose express shipping, orders for Stripe Issuing bulk cards for your customers to the UK are not charged as well.

However, there will be a bulk shipping charge when you choose priority delivery. The shipping cost for priority delivery is 16 GBP.

The Issuing connection fee is a fee that will stand applied for using Stripe Connect (Connect your platform to Issuing and Treasury) which is required if you wish to connect your platform to Issuing and Treasury from Stripe. They charge a $2 fee, but it is not mandatory to pay it since you will have direct access to your Issuing and Treasury account. This fee will be deducted from your platform every month.

The ACH transfer fee is a fee they charge you to reload your Issuing account. Stripe Issuing will charge you $0.50 per account debit authorization, and $4.00 per failed debit authorization.

Stripe Issuing cross-border fees are fees that are charged when the cardholder has a transaction initiated in one country and completed in another country using the card's currency, resulting in cross-border fee.

Stripe Issuing's cross-border fee is 1.00% of the transaction amount + $0.30 per cross-border transaction. Its fee will stand reduced for the first $500K spent on Issuing cards. From the, it will be 0.2% + $0.20 per transaction. They will stand calculated and charged every month.

Here is an example: If the cardholder is visiting Canada and has decided to pay a Canadian merchant in Canadian dollars, and while their card is in US dollars. Stripe Issuing will apply a cross-border transaction fee to complete the transaction.

Stripe Issuing's currency conversion fee is a fee that's charged when the cardholder chooses to pay a merchant in a currency other than the card currency. Stripe Issuing assigns a fee of 1.00% of the transaction amount per transaction for each transaction that requires a currency conversion.

The Stripe Issuing dispute fee is a fee that will be charged to your account in case you file a complaint against a merchant for fraudulent transactions on your Issuing card. It will cost you $15 to dispute them, and you can dispute them on Stripe's disputes page. For each dispute filed, its fee will stand deducted from your account.

To submit your application to Stripe Issuing, you must complete the following steps:

1. Go to the Stripe Issuing page. Here is a link that will take you directly there.

2. Click on contact the sales team.

3. Fill out the form. You are now on the Stripe Issuing sales team page. You need to fill out this form correctly so that they can verify if your business is eligible to use Stripe Issuing.

You should start there if you want to work with Stripe Issuing as a distributor of payment cards. Hence, if the Issuing sales team denies you access. Here's what you need to do the next time you submit your application so that they don't reject it again.

Stripe Issuing's sales team can reject your application if they don't think the way you're going to use Issuing to distribute your cards is right for them. Thus, here's what you need to do to prevent them from rejecting again.

1. Make sure your company is available and has a website that clearly shows how you will use Issuing in your business. That way, the Issuing sales team will have an idea of your usage and whether or not it's right for you.

2. When you submit your application, you must do so carefully, accurately, and in detail. For example: In the section of the form that is facultative and who says: "Anything to add?". You should not leave it blank and you should make sure you describe your project well. Do not write one or two lines in this question. Instead, I suggest you write briefly to explain the purpose of your use. Make sure you write clearly where the bulk of your customers will come from. Stripe Issuing will accept you better easily if the majority of your customers are from Europe, the United States, and the United Kingdom.

3. Don't submit your application if you don't intend to use Stripe Issuing right away or if your budget isn't ready yet. You may have trouble getting your application accepted when you are ready.

4. When they ask you to write the name of your website, make sure it talks about payment card distribution and has a contact page so they can contact you anytime.

5. Stripe Issuing may approve you quickly if you choose "Less than $50K" in "Payments Volume." However, it can also back you even if you choose "None, just getting started," but it will depend on your use case and the number of people who will order their cards from you.

A: That's a Stripe feature that you must obtain authorization before using. Each user's file will stand reviewed to determine if they are eligible. The Stripe Issuing team would like to make sure it's right for you.

A: You don't need to provide any documentation to register with Stripe Issuing. You only need to fill out this form so they can check if you are eligible and see your use case.

A: You should wait 7-10 business days from the date of your submission.

A: Yes. But you must prove that you have its documents:

A: The Stripe Issuing team will send a confirmation message to your email address.

A: No. You do not need a Treasury account to apply for Stripe Issuing. Stripe Issuing and Treasury are two services that are linked to your financial account and independent of each other. You do not need to have one to use the other.

A: Stripe Issuing is available in the US and UK. But an invitation can stand requested in 20 other countries by contacting the Issuing sales team.

A: No. Stripe Issuing is not yet available in Canada. At the moment, they are only available in Europe, the UK, and the US. Therefore, you can apply to the Issuing sales team for acceptance.

A: Stripe Issuing is a product offering that allows users to create cards and issue them on behalf of their cardholders for business expenses. Conversely, Stripe Treasury is the product they offer for businesses. It is an on-demand banking API that allows you to integrate financial services with your marketplace or platform. With a single integration, allow your customers to hold funds, pay bills, earn yield and manage cash flow.

A: Stripe Issuing needs three and seven business days for Stripe Issuing to add money to your card after you request a cancellation or refund from the merchant. If a refund is not possible, Stripe offers a guided dashboard process and API to submit complaints and track their progress to resolution. This process typically takes between 30 and 90 days.

A: No. ATM access is not generally available, as this is still a beta feature. However, the cardholder stands just permitted to withdraw funds from ATMs found in the US, UK, and Europe.

A: No. No fees will be charged to the Card if the transaction was in the same currency. No fee will be charged to the card if the transaction was made in the currency of the card. However, if the transaction was made in another currency, a cross-border fee will be charged. It reduces the card's transaction fee for the first $500K spent on Issuing cards. Its cross-border fee will then be 0.2% + $0.20 per transaction.

A: No. There will be no annual fee for using the card.

That's it. You are now ready to distribute payment cards without stress. If you apply everything I just showed you, you can grow your business and make a lot of money distributing payment cards from Stripe Issuing. There are other providers like Stripe Issuing that you can use as an alternative in case they don't accept your business.

The Bloggors Blog shows you just what you need to do when it comes to communication and how you ought to improve to be the best version of yourself. However, we are not responsible for any disputes you may have when putting our advice into practice, although this doesn't want that our articles are not correct or safe. All our articles have been written by authors who are experts in their field. Some of his solutions may work for others and may not work for you.