Before Moving to Bitcoin halving, you must know how the network operates. Understand how the Bitcoin blockchain works - Read More

Bitcoin's blockchain experiences significant milestones known as halvings, which profoundly impact the network. These events involve reducing the mining reward and cutting it in half. Until 2020, miners received 12.5 bitcoins (BTC) for successfully mining a block.

What is Bitcoin Halving?

Bitcoin Halving occurs every four years in the Bitcoin network. It refers to reducing the block reward that Bitcoin miners receive for adding new blocks to the blockchain.

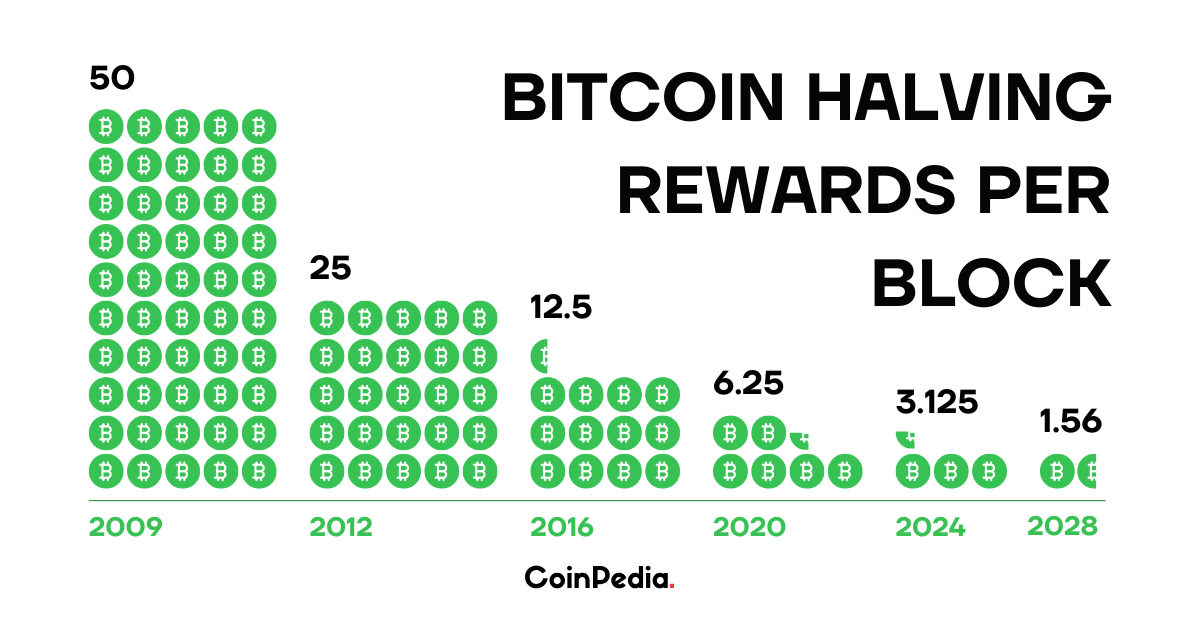

Initially, when Bitcoin was created in 2009, miners received a reward of 50 Bitcoin for every block they said. This reward was later reduced to 25 Bitcoin in 2012 and further to 12.5 Bitcoin in 2016. The significance of the Bitcoin halving extends beyond supply control. It influences the economics of Bitcoin mining, incentivizing miners to become more efficient and adapt to lower rewards.

In simple terms, let's use an example:

Imagine you have a jar of cookies, and you and your friends enjoy them daily. Initially, you allow everyone to have ten cookies daily. But you have a rule where every month, the number of cookies each person can take is reduced by half. This makes the cookies feel more special as they become scarcer over time.

In the world of Bitcoin, something similar happens. When Bitcoin was first created, people could earn a lot of new Bitcoins (digital money) through mining. However, every four years, the number of new Bitcoins that can be mined is cut in half. This scarcity can make Bitcoins more valuable over time, just like your cookies become more precious as they become less available.

Timeline of Past Bitcoin Halving

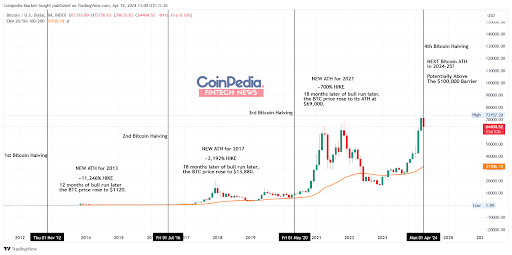

The first Bitcoin halving occurred, reducing the block reward from 50 BTC. Following the event, Bitcoin’s price rose from around $12 to $1,150 over the next 12 months, representing a 9,483% increase.

Bitcoin Halving Prediction - 2024

Bitcoin's highly anticipated halving event, set for April 2024, is stirring excitement in the crypto community. Historically, halving events have sparked significant interest and bullish sentiment among investors, often leading to notable price surges.

Since the inception of Ethereum, the altcoins sector has shown a strong linkage to the biggest crypto, Bitcoin. As mentioned before, Bitcoin halving has created bull runs in Bitcoin prices, leading to phenomenal returns in the halving years.

With a close linkage to Bitcoin, the altcoin sector repeats a similar story with amplified returns, thanks to their lower market cap. In the past two Halving years, 2016 and 2020, the altcoin industry market cap increased by 1027% and almost 300% annually, respectively.

With just a few left for the Bitcoin Halving 2024 and the solid start of 65% in the first three months of 2024, the sector is setting the stage for a massive surge.

Further, the following year of Bitcoin Halving maintains the momentum to prolong the uptrend. Hence, 2024 and 2025 could bring massive returns for altcoin HODLers.

Based on historical moves, market experts predict Bitcoin's price will surpass $100,000 in 2024. However, the impact of the 2024 halving will depend on many factors, including market adoption, regulatory developments, pending decisions on Bitcoin Spot ETF, and broader economic conditions.

| Event | Date | Reward (BTC) | Mined (BTC) |

|---|---|---|---|

| Launch | January 2009 | 50 | 10,500,000 |

| Halving 1 | November 2012 | 25 | 5,250,000 |

| Halving 2 | July 2016 | 12.5 | 2,625,000 |

| Halving 3 | May 2020 | 6.25 | 1,312,500 |

| Halving 4 | March 2024 | 3.125 | 656,250 |

| Halving 5 | Expected 2028 | 1.5625 | 328,125 |

| Halving 6 | Expected 2032 | 0.78125 | 164,063 |

Bitcoin Price Prediction Post Halving - See What’s in store for BTC Price in 2024; Expert Prediction and Key Updates - Read More

Why does Bitcoin halving happen?

- Controlled Supply: As mining rewards decrease, miners rely more on transaction fees, helping to keep the Bitcoin network secure and sustainable in the long run.

- Inflation Control: The halving event in Bitcoin lowers the rate of new Bitcoin creation, effectively slowing down the increase in total supply and reducing the inflation rate.

- Increasing Scarcity and Potential Value: The halving can make Bitcoin scarcer, potentially increasing its value if demand stays the same or rises, similar to essential supply and demand principles.

- Encouraging Investment: The expectation of a Bitcoin halving can spark investor interest, as they often see the slower supply growth as a sign that Bitcoin's value could rise.

- Network Security and Miner Incentive: As mining rewards decrease, miners rely more on transaction fees, helping to keep the Bitcoin network secure and sustainable in the long run.

How Bitcoin Halving Takes Place?

Bitcoin halving is a process designed to control the creation of new Bitcoins and help regulate the total supply. Here's a simple example to explain how it works:

Imagine a small village where gold mining is the primary source of income. Every four years, the village council decides to reduce the amount of gold each miner finds by half. Initially, miners find 100 grams of gold per day. After four years, this amount is reduced to 50 grams per day, then 25 grams after another four years, and so on.

Something similar happens in the Bitcoin network. The Bitcoin network is maintained by miners who use their computing power to process and secure transactions. In return, they are rewarded with new Bitcoins.

Initially, when miners successfully added a block of transactions to the blockchain (Bitcoin's digital ledger), they were rewarded with 50 Bitcoins. However, this reward is halved every 210,000 blocks (approximately every four years). So, after the first 210,000 blocks, the reward was reduced to 25 Bitcoins, then to 12.5 Bitcoins after the following 210,000 blocks, and so on.

This mechanism is fundamental to Bitcoin's design to ensure its scarcity and value over time. It's like the village council's decision to reduce the gold output, ensuring that gold remains valuable because it becomes more scarce.

Impact of Bitcoin Halving on Miners

The impact of Bitcoin's halving on miners is significant and multifaceted. The reward for mining new Bitcoin blocks is halved, which means miners receive 50% less Bitcoin for every block they successfully mine than before the halving.

Here are some of the critical impacts of this event on miners:

Reduced profitability:

Bitcoin halving cuts mining rewards, challenging the financial sustainability of miners with high operating costs and potentially leading to a concentration of mining power among larger, more efficient players.

Increased competition

The decrease in rewards forces miners to optimize operations and innovate, spurring a competitive environment that may favor larger, more technologically advanced mining operations.

Bitcoin Price volatility

Halving events typically influence Bitcoin's market value, often causing price increases before the event and notable fluctuations afterward, reflecting changes in supply expectations.

Increased focus on transaction fees

As mining rewards dwindle, miners increasingly rely on transaction fees, which might impact the network's scalability and user costs, potentially leading to higher fees and longer transaction times.

Drive for Mining Innovation

The need for cost-effective mining solutions post-halving could accelerate innovation in the sector, prompting exploration into renewable energy sources and more efficient mining algorithms.

Enhanced Network Security

Reduced rewards motivate miners to invest in more efficient technologies, potentially leading to a more secure and robust Bitcoin network.

Each halving event is unique, and various factors, including the state of the broader economy, technological advancements in mining, and changes in regulatory landscapes, can influence its impact. The long-term effects of halving are complex and can vary based on how miners and the broader Bitcoin community adapt to these changes.

See what happens when all bitcoins are mined - Read More

Impact on Price

Examining the outcomes of the last three Bitcoin halving events reveals a consistent pattern: a substantial price surge typically commences within six to twelve months following the halving event. Additionally, it's worth noting that in the lead-up to a halving event, Bitcoin's price often experiences an upward trajectory as investors eagerly anticipate a post-halving rally.

Further, the recent all-time high at $73,757 before the halving reflects solid underlying demand and anticipation.